Insights and Analysis: Mortgage and Real Estate Capital Markets Update with Jeff Rosato, SVP of Capital Markets at Nationwide Mortgage Bankers.

Key Takeaways:

Markets saw a major development last week as the Federal Reserve delivered a widely anticipated 0.25% rate cut, bringing the Fed Funds Rate to a range of 3.75–4.00%. However, mortgage rates rose slightly despite the move, underscoring that long-term mortgage pricing is driven by broader market forces, not just Fed policy. Fed Chair Jerome Powell’s strong comments signaled that another rate cut in December is not guaranteed, tempering market expectations. Meanwhile, inflation remains above target at 2.8%, and ongoing delays in economic data due to the government shutdown continue to add uncertainty.

Let’s take a look at how these developments are shaping the bond and mortgage markets this week.

“Powell said that there were strongly differing views among the committee members about how to proceed in December, and that ‘A further reduction in the policy rate at the December meeting is not a foregone conclusion. Far from it.’”

Economic and Fed Outlook

The Federal Open Market Committee (FOMC) voted to cut the benchmark rate by 0.25% last week, as widely expected. The decision, however, was not unanimous — two members dissented, with one calling for a larger cut and another for no change. Powell’s post-meeting remarks introduced new uncertainty into the market, as he emphasized that further easing is not guaranteed.

Markets had priced in a 90% chance of another 0.25% cut in December, but after Powell’s comments, that probability dropped to about 68%. The Fed also announced the end of its quantitative tightening program (QT), which will cease balance sheet runoff after November’s operations and begin reinvesting into short-term Treasuries. This shift is expected to provide mild downward pressure on rates, even if no further rate cuts occur in the near term.

Despite the Fed’s rate cut, inflation remains at 2.8%, still above the 2% target. Powell noted that the effects of tariff policies have been smaller and more temporary than anticipated. He also confirmed that while the government shutdown continues to delay major data releases, private and available public data indicate that the broader economic outlook for employment and inflation remains relatively stable.

Mortgage Rate Movement

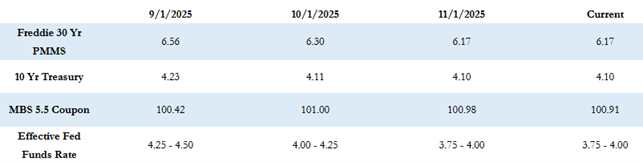

The Freddie Mac average 30-year fixed rate sits at 6.17% as of last Thursday, down 2 basis points from the prior week. This puts the max APR for 30-year fixed loans at approximately 7.67% (6.17 + 1.50). After stabilizing around 6.30% for several weeks, rates resumed a modest downward trend through late October. The 10-Year Treasury yield closed last week at 4.10%, up 10 basis points for the week.

While borrowers may expect lower rates following a Fed cut, mortgage rates often move differently. Long-term mortgage pricing depends more on investor demand, inflation expectations, and bond market sentiment — not just the Fed’s short-term actions.

What’s Ahead

This week, the U.S. October Employment Report will remain delayed due to the shutdown, though the ADP private-sector employment report will still provide a snapshot of hiring activity. Additionally, several Federal Reserve governors are scheduled to speak throughout the week, and markets will be listening closely for any signals on inflation, employment, and future rate policy.

So far today, MBS prices are down about 5 basis points compared to Friday’s close, and the 10-Year Treasury is up slightly to 4.12%.

Here’s to a productive week ahead as markets navigate shifting Fed signals, inflation data delays, and continued uncertainty across the economic landscape.