Insights and Analysis: Mortgage and Real Estate Capital Markets Update with Jeff Rosato, SVP of Capital Markets at Nationwide Mortgage Bankers.

Key Takeaways:

Mortgage rates edged lower last week as bond yields dipped slightly, signaling cautious optimism in the markets ahead of the Federal Reserve’s highly anticipated October meeting. With inflation easing and economic growth moderating, investors are widely expecting a 0.25% rate cut—a move that could further stabilize mortgage rates heading into the end of the year. However, the ongoing government shutdown continues to delay key data releases, adding uncertainty to the Fed’s policy path and the broader housing market outlook.

Let’s take a look at the latest trends, rate movements, and what to watch for in the coming weeks.

“It’s widely expected that the Fed will cut its benchmark rate by 0.25% on Wednesday. Chairman Powell’s press conference will follow immediately after at 2:30.”

Market Overview and Economic Outlook

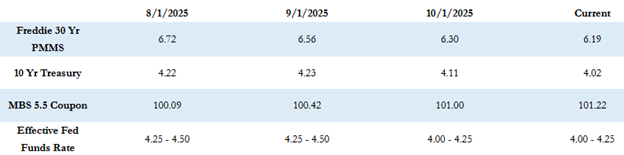

Mortgage rates continued their gradual decline last week, with the Freddie Mac 30-year fixed average falling to 6.19%, down 8 basis points from the prior week. This puts the approximate maximum APR for 30-year fixed-rate loans around 7.69% (6.19 + 1.50). After several weeks of relative stability, the trend suggests renewed momentum toward lower rates. Similarly, the 10-Year Treasury yield ended the week at 3.997%, reflecting modest gains in the bond market as investors positioned themselves ahead of this week’s Federal Open Market Committee (FOMC) meeting.

The ongoing government shutdown, now entering its fourth week, continues to create uncertainty in the markets as crucial economic data—including employment and inflation reports—remain delayed. The most recent Consumer Price Index (CPI) showed a 0.3% month-over-month increase and a 3.0% annual rate, both slightly below expectations. Despite earlier fears, tariffs have not produced meaningful inflationary pressure, giving the Fed room to cut rates.

The market overwhelmingly expects the Federal Reserve to announce a 0.25% rate cut on Wednesday, signaling a continued shift toward an easing cycle aimed at supporting growth amid weakening labor market conditions. A second cut in December remains likely, which could bring the Fed Funds rate into the 3.50–3.75% range by year-end. This trajectory suggests that mortgage rates could finish 2025 between 6.0–6.25%, potentially even lower depending on economic data and global market sentiment.

Looking Ahead

With inflation showing signs of moderation and growth data delayed, the fourth quarter opens under a cloud of fiscal and policy uncertainty. The Fed’s upcoming statement and Chairman Powell’s remarks will be critical for gauging the direction of both short-term rates and long-term bond yields. Should the government shutdown end soon, attention will turn immediately to the long-overdue September employment report and the PCE inflation data, the Fed’s preferred measure of price stability.

As of Monday morning, MBS prices are holding steady and the 10-Year Treasury yield is hovering around 4.02%, suggesting a cautiously optimistic tone ahead of the announcement.

Here’s to a productive week ahead as we close out October with renewed focus on the evolving interest rate landscape, mortgage market stability, and the economic forces shaping the path to year-end.