Insights and Analysis: Mortgage and Real Estate Capital Markets Update with Jeff Rosato, SVP of Capital Markets at Nationwide Mortgage Bankers.

Key Takeaways:

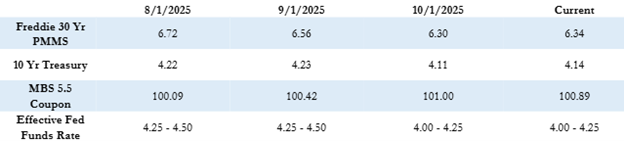

The first week of October opened with renewed uncertainty across financial markets as the partial government shutdown disrupted the release of key economic data. The Freddie Mac 30-year fixed average edged slightly higher to 6.34%, while the 10-year Treasury yield held around 4.14%. The shutdown’s timing has created ripple effects in the housing and capital markets, complicating the Federal Reserve’s next policy decision later this month. Despite the lack of fresh data, investors still anticipate a 0.25% rate cut at the October 29th FOMC meeting, although continued delays could cloud that outlook.

Let’s take a look at the latest trends, rate movements, and what to watch for in the coming weeks.

“Last week the big news was the partial government shutdown that started at midnight on Wednesday. The shutdown has had ripple effects across the housing and capital markets due to delayed economic data.”

Rate Movement

The Freddie Mac average 30-year fixed rate reached 6.34% as of last Thursday—an increase of 4 basis points from the prior week. This places the maximum estimated APR for 30-year fixed rate loans at approximately 7.84% (6.34% + 1.50%).

After eight consecutive weeks of declines through mid-September, mortgage rates have now risen slightly over the last two weeks. Meanwhile, the 10-year Treasury yield closed Friday at 4.12%, marking a 7-basis-point drop for the week. Mortgage-backed securities also showed modest stability, with the MBS 5.5 coupon closing at 100.89.

Economic and Fed Outlook

The dominant story last week was the partial U.S. government shutdown, which began early Wednesday and has already disrupted major data releases—including the highly anticipated September Employment Report, which was postponed. Each day that passes without a resolution increases the risk of a prolonged shutdown, which could further delay inflation and labor market data and potentially lead to federal worker furloughs—adding pressure to an already cooling job market.

The Federal Reserve’s next FOMC meeting is scheduled for October 29th, and the absence of real-time data could complicate policymakers’ decision-making process. Still, the bond markets currently price in a strong expectation for a quarter-point rate cut later this month.

Market Outlook

With the uncertainty surrounding fiscal policy and delayed economic indicators, the fourth quarter has started on uneven footing. This week will feature several Federal Reserve governors and presidents speaking publicly, and any remarks could shift market sentiment or expectations for rate policy.

Should the shutdown end soon, attention will quickly turn to the September employment data and next week’s inflation reports, both of which will be key to shaping rate expectations for the remainder of 2025.

As of this morning, MBS prices are down by roughly 10 basis points from Friday’s close, while the 10-year Treasury yield has edged slightly higher to 4.14%.

Here’s to a steady and successful start to October as markets navigate political uncertainty, economic resilience, and the evolving path of monetary policy.