Insights and Analysis: Mortgage and Real Estate Capital Markets Update with Jeff Rosato, SVP of Capital Markets at Nationwide Mortgage Bankers.

Key Takeaways:

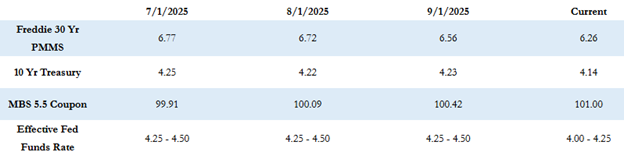

The Freddie Mac 30-year fixed average dropped to 6.26% last week, marking its eighth straight weekly decline and the lowest level in nearly a year. The Federal Reserve cut the Fed Funds Rate by 0.25% and signaled two additional cuts before year-end. Markets are now watching fresh housing, GDP, and inflation data, along with a series of Fed speeches, for signs of where rates will head next.

Let’s take a look at the latest trends, rate movements, and what to watch for in the coming weeks.

“As expected, the Fed acted to cut its benchmark Fed Funds Rate by .25% on Wednesday to a range of 4.0 – 4.25%. The Fed also signaled in its Summary of Economic Projections that there would be two more rate cuts by the end of the year.”

Rate Movement

The Freddie Mac average 30-year fixed rate dropped to 6.26% as of last Thursday, down 9 basis points from the prior week. This marks the eighth consecutive week of declines, following the prior week’s sharp 15 basis point drop—the largest in the past year. The 10-year Treasury yield closed last week at 4.14%, up 8 basis points.

Economic and Fed Outlook

As expected, the Fed cut its benchmark Fed Funds Rate by 0.25% to a range of 4.0 – 4.25% and projected two more cuts before year-end, likely at the October 29 and December 10 meetings. Chairman Powell remained cautious in his post-announcement press conference, reiterating that inflation remains a concern. Bond yields reversed course and climbed on Thursday and Friday despite the cut.

The Fed continues to weigh labor market weakness more heavily than inflation, suggesting further easing through year-end if conditions persist.

This Week’s Schedule

This week’s economic calendar is packed:

- Wednesday: New home sales data

- Thursday: Existing home sales and Q2 GDP

- Friday: Personal Income and Spending, plus the PCE Index (the Fed’s preferred inflation gauge)

Additionally, multiple Fed governors and presidents will be speaking throughout the week, elaborating on last week’s FOMC decision and policy outlook. These speaking engagements could spark renewed market volatility.

So far today, MBS prices are flat compared to Friday’s close, and the 10-year Treasury is steady at 4.14%.

We’ll continue monitoring these developments closely and provide updates as new data and Fed commentary emerge. Here’s to a productive week ahead.