Insights and Analysis: Mortgage and Real Estate Capital Markets Update with Jeff Rosato, SVP of Capital Markets at Nationwide Mortgage Bankers.

Key Takeaways: Bond Market Trends and Fed Outlook

“The Federal Reserve kept interest rates steady last week and signaled that rate cuts are unlikely in the near future due to ongoing inflation concerns. Mortgage rates and Treasury yields remain volatile, with upcoming inflation reports and Fed speeches likely to influence future market direction.”

Key Takeaways: Bond Market Trends and Fed Outlook

“As expected, the FOMC held the Fed Funds rate steady at the conclusion of their May meeting last week. Chairman Powell’s post-FOMC remarks cooled expectations for a near-term rate cut, as futures markets now only price in three cuts by year-end, down from more aggressive assumptions just a few weeks ago.”

Mortgage Rate & Treasury Yield Overview

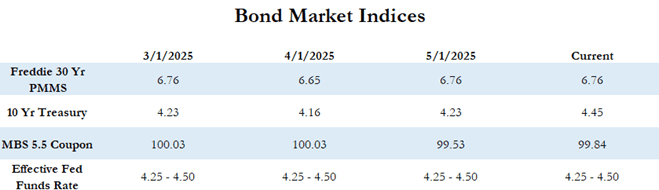

The Freddie Mac average 30-year fixed rate is at 6.76% as of last Thursday and was flat compared to the prior week. That puts the max APR this week for 30-year fixed-rate loans at roughly 8.26% (6.76 + 1.50). Despite recent increases in rates and the extreme volatility, the average 30-year rate has been below 7% since mid-January. The 10-year Treasury yield has also been very volatile and closed the week at 4.38%, which was an increase of 6 basis points for the week.

Fed Meeting Recap & Outlook

As expected, the FOMC held the Fed Funds rate steady at the conclusion of their May meeting last week. Chairman Powell’s post-FOMC remarks cooled expectations for a near-term rate cut, as futures markets now only price in three cuts by year-end, down from more aggressive assumptions just a few weeks ago.

The probability of a rate cut in June has dropped below 20% based on Fed futures markets, down from greater than a 50% chance just a few weeks ago. Three 0.25-point cuts are still expected by year-end, which would put the Fed Funds rate in a range of 3.5%–3.75%.

Powell flagged the uncertain impact of potential new tariffs, noting they could delay progress on inflation and employment goals. The market remains optimistic that slowing data will eventually push the Fed to act on rates, but Fed policymakers remain cautious and unwilling to move without clear evidence of economic deterioration.

The tone of the FOMC statement and Powell’s comments signaled that there is increasing concern over potential stagflation, which is characterized by high inflation coupled with stagnant economic growth and high unemployment. The growing risks to inflation and employment hinge largely on how the Trump Administration’s tariff policy evolves.

Key Economic Data This Week

This week the economic calendar is busy and includes important fresh inflation data. The CPI will be released on Tuesday, followed by the PPI on Thursday, and these reports will be the first important inflation data releases after the last FOMC meeting.

There are also many Fed speaking engagements this week, highlighted by Chairman Powell making a speech on Thursday morning. Market participants will be looking for more insight on how the fresh inflation data relates to their overall strategy and the FOMC statement from last week.

So far today, MBS prices are down by about 10–15 basis points compared to Friday’s close, and the 10-year is up by about 6 basis points to 4.43%.

Stay tuned for next week’s blog for more updates and insights.